1) What “Total Cost of Ownership” really means (and why purchase price lies)

A mini excavator can look “cheap” on day one and still be expensive over five years. That’s because TCO = everything paid to own + everything paid to keep it working + everything lost when it’s not working.

For a small business, the biggest traps are:

- Buying a low-price machine that loses value fast (weak resale).

- Underestimating downtime (missed jobs cost real money).

- Importing a machine that can’t pass local compliance checks (paperwork kills deals before the first start).

Depreciation is a big chunk. Excavators commonly drop ~20–25% in the first year, then ~5–10% per year after depending on care and market demand.

2) Why 1–3 ton minis are the sweet spot for small businesses

Most small contractors, landscapers, farm service crews, and rental startups pick 1–3 ton for one simple reason: they do “paid work” in tight places without needing big transport.

Typical reasons they outperform bigger iron:

- Fit through gates, backyards, small urban sites

- Lower fuel burn (often ~1–2 L/hr for ~1 ton and ~3–5 L/hr for ~3 ton depending on load and operator)

- Easy to rent out and easy to keep busy (trenches, drainage, footings, stumps, light demo, utility repair)

3) The TCO buckets that actually move the needle

Forget the brochure. These buckets decide if the machine “prints money” or “eats cash”:

A) Purchase price + landed cost

If importing, “machine price” is only the beginning:

- Ocean freight / inland trucking

- Duty / brokerage

- Compliance testing (sometimes)

- Dealer setup or local prep (sometimes)

B) Fuel (small per hour, big over years)

Fuel is predictable and easy to budget. A practical planning range:

- Micro / 0.8–1 ton: ~1–2 L/hr

- Around 3 ton: ~4–5 L/hr in real work

Those ranges line up with rental-industry budgeting guidance.

C) Scheduled maintenance (filters, oils, grease)

Maintenance cost is not scary—until it’s skipped.

A mainstream reference point: engine oil & filter around 500 hours, fuel filter around 400 hours, hydraulic filter around 500 hours, hydraulic oil up to 3,000 hours on some mini lines.

(Exact intervals vary by engine, climate, fuel quality, and job conditions—dusty sites shorten intervals.)

D) Wear parts (undercarriage, buckets, pins, rubber tracks)

This is where low-cost machines can get expensive:

- Rubber tracks and undercarriage parts can be a major bill if the machine lives on sharp rock, demolition debris, or curb edges.

- Track life varies wildly by surface and operator habits; many suppliers cite “up to a few thousand hours” under normal conditions.

E) Downtime (the silent killer)

A $2 O-ring leak becomes a $500 problem if:

- the hose routing rubs through,

- parts take 2–3 weeks,

- jobs get delayed,

- a rental customer demands a refund.

F) Resale value (your “exit plan”)

This is often the real difference between “cheap” and “smart.” The market consistently rewards:

- clean service history,

- known engine compliance,

- predictable parts availability,

- recognizable brand/support network.

4) A simple 5-year TCO worksheet (with break-even hours)

Here’s a clean way to decide “buy vs rent” and “China new vs used premium.” Plug in real quotes.

Step 1: Estimate total hours

Most small businesses fall into one of these:

- Low use: 100 hours/year (seasonal, occasional jobs)

- Medium use: 300–600 hours/year (steady small contractor)

- High use: 800+ hours/year (rental fleet / full-time dig crew)

Step 2: Ownership cost per hour

Ownership cost/hour = (Purchase + Landed + Setup − Resale) ÷ Total hours

Depreciation patterns (first-year drop then slower decline) are common across excavator markets.

Step 3: Operating cost per hour

Operating cost/hour = Fuel + Maintenance + Wear parts + Repairs reserve

Fuel ranges for small excavators can be budgeted from real-world rental guidance.

Step 4: Compare to rental

Typical mini excavator rental ranges often land around:

- $30–$50/hour

- $150–$350/day

- $600–$1,400/week

Large platforms also publish example daily/weekly/monthly mini-ex rental pricing.

A quick break-even example (simple, not “perfect”)

Assume a small business is considering a 2–3 ton China mini excavator.

Example assumptions (replace with real quotes):

- Landed cost: $25,000

- Resale after 5 years: $9,000 (depends heavily on brand acceptance + condition)

- Fuel: 4 L/hr

- Maintenance & wear: $4/hr

- Repairs/downtime reserve: $2/hr

- Diesel price: whatever local rate is

5-year ownership cost/hour

Total hours if 400 hrs/year → 2,000 hrs

Ownership cost = 25,000 − 9,000 = 16,000

Ownership/hour = 16,000 ÷ 2,000 = $8/hr

Operating (excluding fuel price) = 4 + 2 = $6/hr plus fuel price per hour

If diesel is $1.50/L, fuel = 4 × 1.50 = $6/hr

Total ≈ 8 + 6 + 6 = $20/hr

Now compare renting at $30–$50/hr typical range.

At medium-to-high annual hours, buying usually wins if downtime is controlled.

But if usage is only 100 hrs/year → 500 hrs total:

- Ownership/hour = 16,000 ÷ 500 = $32/hr

- Add operating + fuel and it can easily land near or above rental.

Plain-English takeaway:

A China mini can be “worth it” fast at 300–600+ hours/year, but can be hard to justify at very low annual hours unless it’s also generating rental income.

5) China mini excavator: when it’s worth it—and when it’s not

It’s often worth it when…

- The business needs a new machine with warranty but can’t justify premium-brand pricing.

- Annual utilization is medium to high (the machine stays busy).

- The buyer is willing to run a basic parts + maintenance discipline (filters on time, grease daily, hose inspections).

- The supplier can prove compliance + traceability (serials, engine plate, declarations, real documents).

It’s usually not worth it when…

- The machine will be used only a few weekends per year (renting is simpler).

- Jobs are penalty-heavy (utility work, tight deadlines) and downtime is catastrophic.

- Local rules require emissions or CE/noise documentation that the machine can’t satisfy (paperwork becomes the “most expensive part”).

6) The “hidden reliability” checklist

This is the stuff that decides whether a machine feels tight after 1,000 hours—or starts “sweating oil” and loosening up.

Hydraulic system “tells”

- Hose routing: no rubbing points, proper clamps, no sharp bends near fittings

- Valve/pump matching: smooth combined movements (boom + stick + swing) without starving

- Leak control: clean crimping, correct fittings, no paint over oily areas (classic cover-up)

Structure & welding (real world)

- Look for consistent weld beads, no undercut, no burn-through, good gusset fit-up.

- Ask if the factory uses WPS / welding process control and records. WPS is widely recognized as a quality-control tool to keep weld outcomes consistent.

Undercarriage reality

- Track tension system should be easy to adjust.

- Rollers/idlers should be aligned—misalignment eats tracks fast.

- If the machine will work on demolition debris, plan for faster track wear.

End-of-line checks that matter

Ask for proof (photos/video) of:

- hot run / function test

- travel test both speeds

- swing brake/holding test

- cylinder drift check

- leak check after warm-up

A supplier that can’t show basic testing evidence is asking the buyer to “pay to find out.”

7) Compliance & paperwork: the fastest way deals go sideways (EU/UK/US highlights)

For many importers, “worth it” is decided by documents, not metal.

EU machinery compliance

The European Commission notes machinery placed on the EU market before 20 January 2027 must comply with the Machinery Directive 2006/42/EC (with the newer Machinery Regulation applying from 20 January 2027).

EU Stage V engines (emissions)

Stage V is governed by Regulation (EU) 2016/1628 for non-road mobile machinery engines.

Outdoor noise labeling (often overlooked)

The EU Outdoor Noise Directive requires CE marking + guaranteed sound power level labeling for covered equipment categories.

US EPA nonroad engines

The EPA provides regulations covering nonroad compression-ignition engines used in equipment like excavators.

Practical warning: “CE” stickers and “EPA” claims are not the same as traceable documentation. If certificate fraud is a known worry, the safest habit is simple: verify document numbers and match them to the machine serial/engine label before shipping.

8) How to lower risk (without overcomplicating it)

Buy the machine like a small fleet manager

Even if it’s one unit, treat it like a fleet purchase:

- Request a spare parts starter kit (filters, belts, common sensors, seal kits, a couple hoses)

- Require a parts list with part numbers and clear photos

- Lock down lead times for hoses/cylinders/pump parts

Do a “downtime budget”

Set aside a repairs reserve per hour (even small, like $1–$3/hr). If it’s not used, great. If it’s used, the business won’t panic.

Match machine size to revenue jobs

- If most work is trenching/drainage and light demo, a 2.5–3 ton class usually earns more per day.

- If most work is backyard access and tight landscaping, a 1–1.8 ton can keep moving where bigger machines waste time.

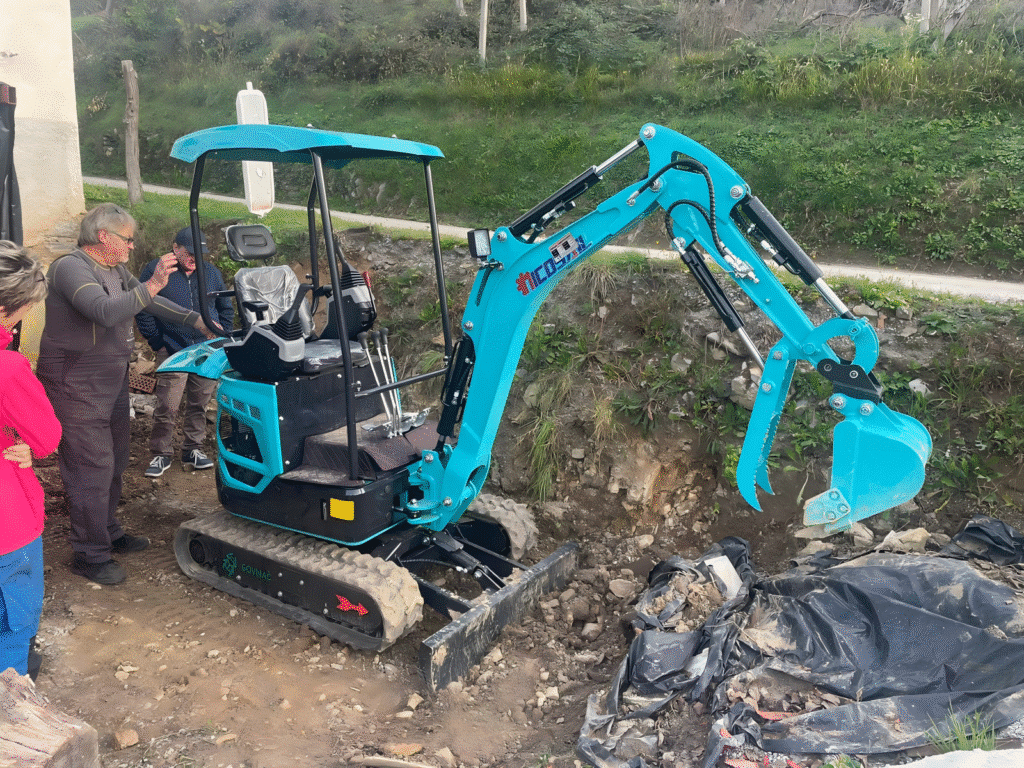

9) Where Nicosail fits

For buyers who want China pricing but want fewer surprises, the safest route is usually a factory-direct brand that can show:

- production-line consistency,

- serial traceability,

- real pre-shipment test media,

- clear spares support and documentation.

That’s the lane where Nicosail is often a sensible shortlist option: not because the logo is magic, but because the purchase becomes a repeatable process (documents, inspection, spare parts, delivery planning) instead of a one-time gamble.

FAQ

1) What annual hours make buying a mini excavator worth it?

Often around 300–600+ hours/year buying starts beating renting, especially if rental rates are in the common $30–$50/hr range.

2) Is renting smarter for low usage?

Usually yes. At ~100 hours/year, depreciation per hour can get ugly fast unless resale stays strong.

3) What fuel burn should be budgeted for 1–3 ton machines?

Real-world planning ranges often sit around 1–2 L/hr for ~1 ton and ~4–5 L/hr for ~3 ton, depending on load and operator habits.

4) How often do filters and fluids need changing?

Intervals vary, but common references include hundreds of hours for filters and much longer for hydraulic oil on some mini lines.

5) What’s the #1 risk with a cheap import mini excavator?

Not “it breaks.” Everything breaks eventually. The real risk is downtime + parts delay + unclear documents.

6) How can certificate fraud be avoided?

Verify certificate numbers, match the paperwork to serial/engine plate, and use third-party inspection before shipment.

7) Does Stage V matter if selling into Europe?

Yes—Stage V requirements are set under EU rules for nonroad engines, and enforcement risk sits with the importer and seller.

8) Do mini excavators hold value?

Many do if maintained well; depreciation often drops hard in year one then slows.

9) Should a small business buy new China or used premium brand?

If uptime is critical and resale matters, used premium can win. If cash flow is tight and the machine will be kept busy, a well-supported China unit can win.

10) What should be demanded from the supplier before payment?

Serial photos, engine plate photos, document samples, inspection checklist, test videos, parts list, and written lead times.

Summary

A 1–3 ton China mini excavator can absolutely be worth it for a small business—when utilization is high enough and downtime risk is managed. The purchase price is only step one. The real decision is made by resale value, parts speed, maintenance discipline, and compliance paperwork.

For many small operators, the best strategy is simple:

- Rent if annual hours are low or jobs are occasional.

- Buy (China or used premium) if the machine will stay busy—and treat the purchase like a fleet decision with inspection, spares, and documentation locked down.

- Shortlist suppliers (including options like Nicosail) that can prove process, testing, and traceability—because that’s where “invisible reliability” lives.